All You Should Know About Interactive Brokers

Mar 21, 2024 By Susan Kelly

Exploring the landscape of brokerage services in 2024, this article offers an in-depth review of Interactive Brokers, a leading platform in the financial industry. Providing insights into its offerings, strengths, and weaknesses, this review aims to assist readers in making informed decisions about their investment strategies and brokerage service preferences.

Platform Overview

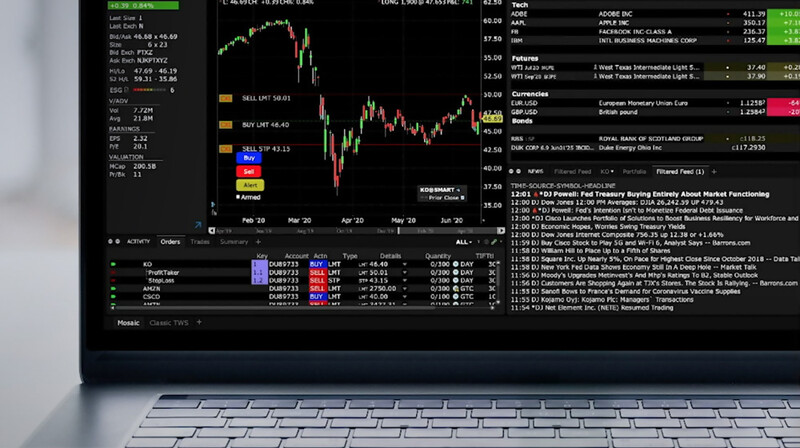

Renowned for its diverse range of investment products and sophisticated trading tools, Interactive Brokers is a prominent player in the brokerage industry. It caters to both individual traders and institutional investors. Its platform boasts an extensive array of financial instruments such as stocks, options, futures, and currencies. It also includes bonds. With advanced technology infrastructure underpinning its global presence, Interactive Brokers provides a robust trading platform that meets various investor needs worldwide.

Interactive Brokers, expanding its global reach, offers access to more than 135 markets in 33 countries. This allows traders not only to diversify their portfolios but also to seize emerging opportunities worldwide. Moreover, with the platform's multi-currency capabilities, seamless transactions and account management across various currencies become possible. Thus, facilitating international trading for investors.

- Advanced Order Types: Interactive Brokers offers a wide range of advanced order types, including stop-limit orders, trailing stops, and bracket orders, allowing traders to execute precise trading strategies and manage risk effectively.

- Mobile Trading App: The platform's mobile trading app provides on-the-go access to market data, order execution, and portfolio management, ensuring traders can stay connected and make informed decisions wherever they are.

Key Features and Tools

One of the notable aspects of Interactive Brokers is its comprehensive suite of trading tools and analytical resources. From advanced charting software to real-time market data, traders have access to a wealth of information to facilitate their investment decisions. The platform also offers customizable trading algorithms, risk management tools, and portfolio analysis features, empowering users to optimize their trading strategies and mitigate risks effectively.

Interactive Brokers, aside from its comprehensive research offerings, equips traders with a wealth of educational resources and webinars to augment their knowledge and skills. These encompass an expansive spectrumranging from fundamental analysis to advanced trading techniques. They are tailored for all experience levels. Thus, catering extensively to trader development.

- Paper Trading Simulator: Interactive Brokers offers a paper trading simulator that allows users to practice trading strategies in a simulated environment without risking real capital, providing valuable hands-on experience and learning opportunities.

- Integrated API Solutions: For institutional clients and advanced traders, Interactive Brokers provides comprehensive API solutions for automated trading, algorithmic trading, and custom software development, enabling seamless integration with third-party platforms and applications.

Cost Structure and Fees

Interactive Brokers offers a diverse array of investment opportunities. However, one must consider the accompanying costs and fees. The platform employs an open pricing structure. It boasts competitive commission rates, while keeping margin borrowing costs low, a strategy that promotes transparency. Yet, traders should remain vigilant against specific charges such as account maintenance fees and inactivity penalties. these could potentially fluctuate based on account type trading volume and data subscription expenses.

Based on their trading preferences and investment goals, traders have the option to select from a variety of account types including individual accounts, joint accounts, including retirement accounts among others. It is crucial that one meticulously reviews the terms and conditions before initiating an account as each type may feature distinct fee structures with specific eligibility criteria.

- Volume Discounts: Interactive Brokers offers volume discounts on trading commissions for high-volume traders, providing cost savings for frequent traders who execute large order sizes.

- Fee Waivers: To attract new clients and incentivize trading activity, Interactive Brokers occasionally offers promotional incentives, such as commission-free trades or fee waivers for specific products or services.

Pros and Cons

As with any brokerage service, Interactive Brokers has its strengths and weaknesses. On the positive side, the platform offers a vast selection of tradable assets, low trading commissions, and advanced trading tools, making it an attractive choice for active traders and sophisticated investors. However, some users may find the platform's interface complex and challenging to navigate, especially for beginners. Additionally, while Interactive Brokers provides access to global markets, certain markets may have limited liquidity or availability, which could impact trading opportunities.

Traders must also consider the platform's margin requirements and leverage ratios. Excessive leverage amplifies both profits and losses, a potential risk that could lead to substantial losses. Furthermore, though Interactive Brokers presents competitive pricing; traders need awareness of currency conversion fees' possible impact, along with other hidden costs, on their overall trading expenses.

- Direct Market Access: Interactive Brokers provide direct market access (DMA) to various exchanges and liquidity providers, allowing traders to execute trades directly on the exchange order book, resulting in faster order execution and potentially better prices

- Regulatory Compliance: Interactive Brokers operates in multiple jurisdictions worldwide and is subject to regulatory oversight by relevant authorities, ensuring compliance with industry regulations and investor protection measures.

Customer Support and Security

Interactive Brokers prioritizes offering responsive customer support through various channels such as phone, email, and live chat. The platform also places a high emphasis on security and regulatory compliance by implementing robust encryption technologies. It adheres diligently to industry best practices for safeguarding clients' funds and personal information. Interactive Brokers aims deliberately at maintaining the trust, even confidence, of its user base with an unwavering commitment towards transparency coupled with integrity.

Clients of Interactive Brokers access detailed account statements, transaction history, and tax reporting tools. These facilitate transparent and accurate record-keeping for tax purposes. Moreover, the platform offers robust account protection measures such as two-factor authentication and biometric login options to enhance security, mitigating risks associated with unauthorized access.

- Educational Resources: Interactive Brokers offers a comprehensive knowledge base and FAQs section on its website, covering a wide range of topics related to trading, account management, and platform features, providing valuable resources for self-help and troubleshooting.

- Secure Client Portal: The platform's secure client portal allows users to manage their accounts, access account documents, and perform account-related tasks securely, providing a convenient and user-friendly interface for account management.

Conclusion

In conclusion, investors seeking a comprehensive brokerage platform with diverse investment options and advanced trading tools should consider Interactive Brokers as their top choice. Despite potential drawbacks such as its complex interface and fee implications, many traders find that the extensive range of features it offers along with global market access overshadow these concerns. Individuals should base their decision to use Interactive Brokers on their investment objectives, trading preferences, and risk tolerance.

-

Mortgages Mar 21, 2024

Mortgages Mar 21, 2024Navigating PenFed Credit Union Loans – 6 Options

Explore PenFed Credit Union loans for your financing needs. Learn about their offerings and how to this huge financial help for your future.

-

Taxes Jan 14, 2024

Taxes Jan 14, 20247 Best Mortgage Refinance Lenders

Here are the top mortgage refinance lenders that offer reasonable rates and smooth experiences for smarter financial decisions

-

Investment Dec 25, 2023

Investment Dec 25, 2023Dive or Decide: Navigating the Purchase of a Home with a Pool

Thinking about buying a house with a pool? Make an informed decision by answering these 5 essential pool-buying questions and avoid regrets.

-

Investment Mar 21, 2024

Investment Mar 21, 2024All You Should Know About Interactive Brokers

Uncover a comprehensive review of Interactive Brokers' brokerage services in 2024, including features, pros, and cons.