A Detailed Overview of Seller Financing You Must Not Miss

Feb 06, 2024 By Triston Martin

It takes a lot of effort to get approved for a mortgage. Many lenders have strict requirements and often reject candidates with bad credit or too much debt. If you are committed to purchasing a home, one option is available for you, "seller financing." As its name suggests, it involves the homeowner financing the buyer's purchase.

The seller typically locates an interested buyer who meets the requirements for a mortgage, including the necessary income, work history, and credit score. Afterward, a bank, credit union, or another lending organization funds the buyer's mortgage.

However, if conventional finance is unavailable, the buyer and seller can still prefer to carry out the transaction secretly. Seller financing is one of their choices in this situation. But you'll need to consider this seriously to see if it's the right idea.

Dont stop scrolling if you want to know about “is seller financing right for your real estate situation?”

How Does Owner Financing Work?

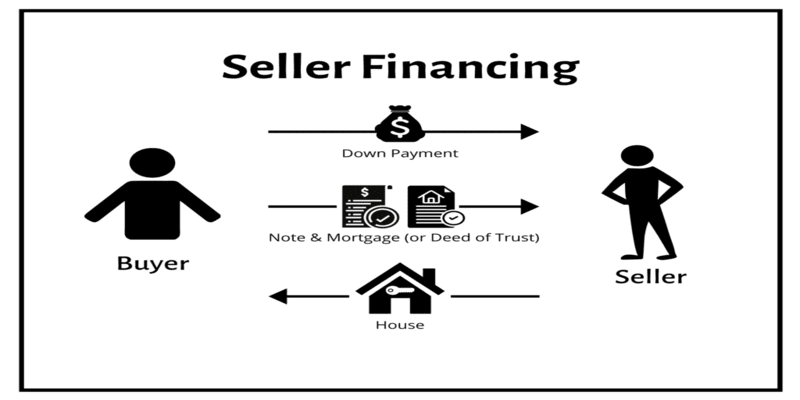

Unlike a mortgage lender, the seller does not provide funds to the buyer in seller financing. Instead, the seller gives the buyer enough credit to cover the cost of the house, less any down payment.

After that, the customer regularly pays until the entire amount is paid. The buyer and seller sign a promissory note outlining the conditions of the loan, which include:

- Rate of interest

- Payback Schedule

- Resulting from a default

- Sometimes, the owner retains the title to the home until the buyer settles the debt.

Perks of Seller Financing

Is seller financing a good idea, the answer is yes because seller-financed sales can be less expensive and faster than conventionally selling a house. After all, there are only two main stakeholders.

And the best part? You can immediately start with a bank loan officer, underwriter, or legal department. It indicates that a seller-financed transaction typically has lower closing expenses, which lowers the buyer's overall transaction cost.

On top of that, the deal avoids origination costs, mortgage or discount points, and other fees that lenders commonly charge when a bank is not involved throughout the financing process.

In the meantime, sellers can sell more quickly without undertaking the expensive repairs that lenders usually demand. Additionally, the property may sell for a high price because the seller is financing the transaction.

What Buyers Should Know About Seller Financing

Despite the potential benefits, there are risks and realities related to using seller financing in deals. Buyers need to consider some things before completing a seller-financed transaction.

Never Expect Better Conditions Than Those of a Mortgage

Flexibility often meets reality while hammering out the parameters of a seller-financed contract. The seller considers the risks to their finances, including the possibility that the buyer will not make loan payments and a costly and complex eviction procedure.

Check If the Seller Can Pay for the Purchase

The most straightforward situation for seller financing is when the seller owns the property outright. More difficulties arise when the property secures a mortgage.

The deed states that the property's accuracy and lack of a mortgage or tax lien can be verified by paying for a title search.

You May Need to Sell Yourself to the Seller

It is suggested to be open and honest about why you were turned down for a conventional mortgage. However, when the seller looks up your credit history and other background information,

Some of that information can still appear. Your job, financial claims, assets, and references will all be included in this.

But highlight any limitations on your borrowing capacity that might have yet to come to light during the seller's due diligence.

Get Your Proposal Ready for Seller Financing

To draw in purchasers who are ineligible for mortgages, homeowners who provide seller financing frequently and transparently disclose this information.

It never hurts to ask if seller financing isn't mentioned. You could make a specific proposal instead of inquiring about the possibility of owner financing.

Things Sellers Need to Know About Financing

If you're thinking about financing the sale of a house, keep these tips and the facts in mind.

Long-Term Financing of the Sale Is Not Necessary

Anytime you want, as the seller, you can sell the promissory note to a lender or investor, and the buyer will deliver the payments to you. The seller may receive cash immediately if this happens on the closing day.

Consider Seller Financing in Your Offer to Purchase the Property

Please start with the property listing and advertise that you offer seller financing because it is uncommon.

The text will make potential buyers and their agents aware of the option by adding the phrase "seller financing available" to the text.

Take A Look at Loan-Servicing Assistance and find Tax Advice.

Engage a financial advisor or tax specialist in your sales team, as seller-financed deals may raise tax issues.

Consider using a loan-servicing business to handle the various tasks linked with loan management, such as issuing statements and collecting monthly payments, unless you are a seasoned and comfortable lender.

Pros and Cons for Buyers

If you are considering going for seller financing, you should know the advantages and drawbacks of this process. Here is a list of seller financing pros and cons.

Pros:

- Faster closing

- Cheaper closing

- Reliable down payment

- A good choice if you cannot get a mortgage

Cons:

- Greater interest Rate

- Payment terms upon sale

- Requires seller consent

- Balloon payments

Pros and Cons for Sellers

Pros:

- Ability to sell without having to make pricey repairs that conventional lenders could demand.

- An excellent investment has the potential to produce higher returns than you would get from investing the money you got from the sale of your house.

- An investor may purchase the promissory note to receive a lump sum payment immediately.

- If the buyer fails to pay, you will keep the house, any money spent, and the down payment.

- Possibility of a quicker closing date due to buyers avoiding the mortgage application process.

Cons:

- The purchaser is free to stop payments at any moment. If this happens and they choose not to go, you may have to go through the eviction procedure.

- Depending on how well the buyer maintained the property, you may have to cover upkeep and repairs if you decide to reclaim the property (for whatever reason).

Conclusion

In this article, you will find the answer to the question, Is seller financing right for your real estate situation? Unlike a bank or other lender offering to sell the buyer a mortgage,

seller financing involves the seller funding the transaction. Undoubtedly, It is a fantastic alternative to a traditional mortgage.

In a complex real estate market, it can be a helpful choice. To reduce these risks and ensure a seamless transaction, it's advisable to enlist expert assistance.

Nevertheless, the arrangement has certain risks for both buyers and sellers. If you are still confused about what is seller financing in real estate, then this article will help you with your queries.

-

Investment Feb 05, 2024

Investment Feb 05, 2024Types of Investment Accounts - Make Huge Profits Now

Investment accounts are favorable, and if you are excited to know how investment accounts can make you money, dig into this post.

-

Investment Jul 31, 2024

Investment Jul 31, 2024Robinhood Overview: Enjoy Free Stock and Commission-Free Trades

The Robinhood Financial app attracts active traders with its wide accessibility and has transformed brokerage despite limited investing options.

-

Banking Feb 07, 2024

Banking Feb 07, 2024Rewards Credit Cards — All You Need To Know

Let’s take a closer look at the rewards credit cards, which may help you determine whether or not a rewards card would be a good fit for you.

-

Investment Jan 16, 2024

Investment Jan 16, 2024Decoding the Real Worth of Farmers Homeowners Insurance: A Thorough Review

Get an in-depth look into Farmers Homeowners Insurance, its comprehensive coverage options, personalized service, and more. Find out if it's the right choice for you.